Betting on WhatsApp

WhatsApp is the next big platform. This guide is for anyone who wants to understand, build, or invest in its future.

I'm not affiliated with Meta or WhatsApp. The views and opinions expressed below are my own and do not reflect those of any company or organization.

There are 1,738 startups on Crunchbase with the word WhatsApp in their descriptions. Of those, 388 are funded. With Y Combinator invested in at least 10 startups that are built entirely on WhatsApp in the last 3 years. What's happening? What are all these startups doing?

In the next six short acts, I will help you make a well-informed bet on a startup you’re looking at or want to build. How? I will give you (1) a formula to vet them, (2) a tour of the WhatsApp landscape, and (3) red flags to watch for – and as a bonus, some predictions.

Act I: Earth? Hello? WhatsApp

You’re here because you’re hearing the word WhatsApp flying around more often than to be ignored – maybe more so in the last 3 years? Maybe you’re seeing big funding rounds from major VCs, or signs of WhatsApp turning into a super app. Maybe all of that, or maybe you’re just curious.

You’re not wrong. You can’t afford to ignore this anymore. I will explain why, but first, here’s something from Scott Galloway’s predictions for 2024 to get us warmed up:

The new swing votes that decide the world economy and world politics are the kingdom (Saudi) and India. India is going to add more consumers to the middle class than any nation in the world. Who does that benefit in big tech? WhatsApp. 95% of Nigerians, 77% of Indians, the number one and number three most populous nations in the world – their primary means of communication is owned by Meta. Also, you read every message on WhatsApp, you don't read every email, you don't even read every text. It's the least monetised platform in the world right now. Think of it as the most under-utilised real estate in the world.

What have we got here?

The least utilised real estate in the world is WhatsApp.

The most populous nations and the country with the most growing middle class in the world use WhatsApp (and will continue to use WhatsApp).

Two powerful statements, backed with facts, to tell us that WhatsApp is the tool humans rely on the most for their daily communications. It is where humans talk to each other today. It is where communication happens, for most of the world.

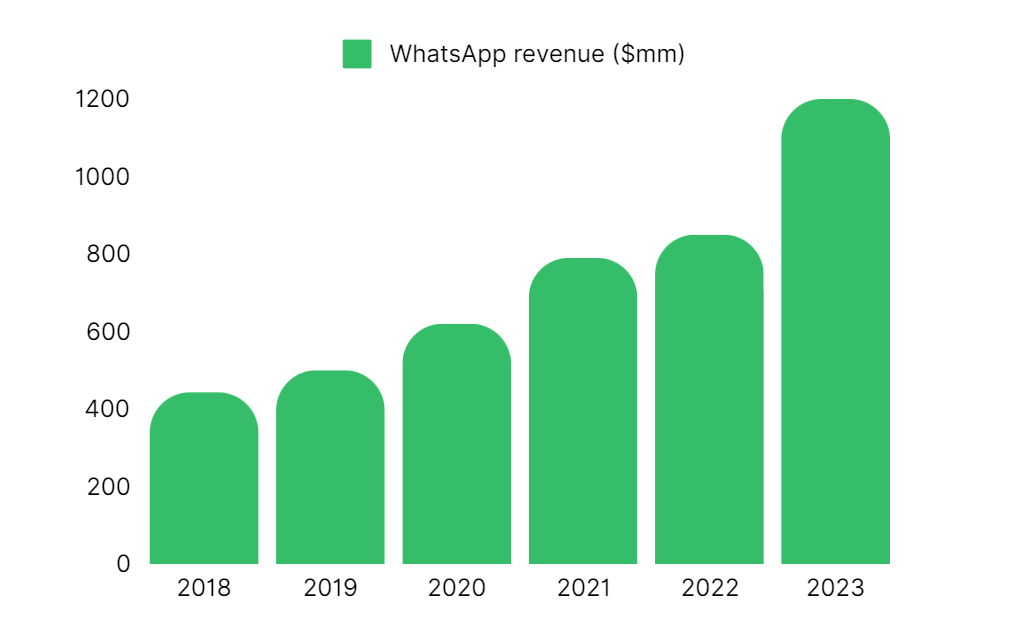

In 2021, WhatsApp generated $790 million in revenue, almost all from the WhatsApp Business App. In 2023, WhatsApp Business made an estimated $382 million - of which $155 million came only from Asia. Europe was the second highest - spending around $90 million on the messaging app.

Since early 2013, WhatsApp has gained 200 million active users & the daily message volume continued to climb. After it was acquired by Facebook in 2014, WhatsApp’s active user base saw an immense 365% increase - from 465 million to 2 billion monthly users.

If you still feel lost on the history, I got you – read on why I think WhatsApp is irreplaceable.

Act II: Why WhatsApp?

By the numbers

If we search Crunchbase for companies with the word WhatsApp in their description, here are what the numbers look like –

1,738 startups (40% of them are software/SaaS)

388 funded startups

31 were acquired

21 made acquisitions

Most of them are headquartered outside the US

These numbers by themselves don't make a thesis, but it must be making you curious.

In contrast, there are 61,000 companies in Crunchbase with the word Email in their description. It’s impressive to compare both, knowing that WhatsApp only released their WhatsApp Business Platform (API) just 5 years or so ago. That was when it became possible to build products over WhatsApp. To put things in perspective, the first email was sent 53 years ago – in 1971. This is a superficial comparison, but it tells us something. A new type of Email alternative is now possible as a business-to-customer communication channel and people are willing to build + bet on it. This is a rare event.

WhatsApp as a platform, by rocket analogy, just started its burn off stage. Companies are still trying to scramble and figure out – How do we utilize this channel? What do you mean WhatsApp has 98% open rate and email has a mere 20%? WhatsApp ate through most of the world – LATAM, India, MENA, Africa, SEA, and it is starting to aggressively eat into the EU (starting from the south, towards the north), and it will peak when it hits the US. It’s happening now, and with proof – read the excerpt below from Meta's Q1, 2024 earning's call by Zuckerberg.

WhatsApp lies so perfectly between a phone call that requires your attention right now, and an email that is async and by nature forgettable. You don't forget about WhatsApp because that's where your friends and family are, and most humans will respond to their friends and family. On their way to get back to their friends, they will see your message(s) from your business and will likely to engage with it.

We are yet to see the peak of the WhatsApp opportunity.

WhatsApp = Platform

Meta is all in on WhatsApp as a platform. But why should you care? Just as smartphones evolved from basic communication devices to platforms for countless apps and services (games, banking, navigation), WhatsApp is transforming from a messaging app to a platform. Endless possibilities unlocked for all companies out there trying to run their businesses over WhatsApp. Every use case that wasn't possible before due to the limitations of the WhatsApp Messenger or the WhatsApp Business App will be possible by building over the WhatsApp Platform.

Meta shipped a ton of features that scream "platform" like flows, payments, interactive buttons, lists, commerce APIs, and a Cloud APIs offering. They're also sunsetting the On-Premise API (an early version of the WhatsApp API), which basically says, "We're betting on the cloud, folks". In their most recent Conversations 2024 conference, they mentioned that they are releasing Voice APIs, Group APIs, and much more.

It is also not just about features, it's about building an ecosystem. Meta's opening up API access, making it easier for developers to jump in and build. They want to attract builders of all kinds – from scrappy startups to big enterprises. They're laying the groundwork for WhatsApp to be as big as, or even bigger than, platforms like Salesforce, Shopify, or Slack. The potential is massive, and it's all about creating tight workflows that businesses will find hard to resist. This is just the beginning – there's a whole lot more to this story, especially with AI in the mix both with their Business App for small businesses and their Cloud API offering.

To recap a few recent events:

Opened up API access, making it easier for developers to build.

Sold Kustomer after a year of acquiring it, to focus on WhatsApp's own platform development.

Launched Cloud API offering, sunsetting the On-Premise API.

Released building blocks for developers – Cloud API, Commerce API, Flows, Interactive Buttons, Lists and more.

Zuckerberg emphasized platform focus in Q1 2024 earnings call.

We must be clear that WhatsApp has three distinct products. The WhatsApp Messenger made for people like you and me to talk to friends and family, the WhatsApp Business App for micro and small businesses – it is also an app like the WhatsApp Messenger with additional features, and most importantly, the WhatsApp Business Platform (API) which is our focus topic for today.

Act III: Early Monetisers

This is the story of how the first wave of companies made their money – by building over WhatsApp. The first release of the WhatsApp API was late 2018 and mid-2019. The release triggered the first WhatsApp gold rush (and I dare say, we're in the midst of the second). But this API wasn't your typical plug-and-play. You couldn’t just get an API key and start building. Hold on, what? You were required to setup a whole infrastructure first. It needed time, effort and a technical know-how. More importantly, you needed to be a very close partner to Meta.

Why was it that way? WhatsApp's magic happens mostly on your phone, with the server side acting as a glorified router. So Meta needed a way to take that client into the cloud and I think they didn’t want to carry the hardware deployment investment themselves – it is basically headless WhatsApp client in the cloud. They outsourced the hosting of this "headless" WhatsApp in the cloud to partners like established CPaaS companies (think Twilio), Telecom companies and a select group of startups.

Initially, access was tightly controlled through Business Solution Providers (BSPs), this created an influx of hundreds of thousands of businesses around the world approaching the BSPs. This was good business for CPaaS and Telco companies (who were BSPs of the WhatsApp Business API), charging per-message fees (later conversation fees) on top of Meta's cut. Meta finally got a taste of WhatsApp revenue, but at a cost.

This model, while lucrative for CPaaS and Telco players, might have stifled Meta's own potential. Or at least I think so. Proof? They're now sunsetting the on-premise API in favor of their own Cloud API offering. Now, the markup-driven CPaaS model has reached its limits. The real value lies in building useful applications on top of WhatsApp.

In hindsight, I think if Meta had invested a few more months upfront in building their Cloud APIs, they might have accelerated their ecosystem growth, attracted more builders, and made more money. Let's be real, Meta knows how to build APIs, so this was likely a strategic decision.

The good news? API access is less gate-kept now, opening up opportunities for a wider range of innovators. This brings us to the second wave of monetisers explaining the landscape.

Act IV: The Landscape

Now that I managed to convince you to write your first cheque for a startup building on WhatsApp (did I? If not, let's have a coffee), where do you actually go from here? What are the pillars of your investment thesis? Don't worry, I got you – I’ve done the homework through building two startups over WhatsApp. One bootstrapped and one VC funded. I also spoke to thousands of businesses over the last 6 years using WhatsApp. Get a sip of coffee, roll-up your sleeves and let's dig.

WhatsApp, as a communication channel, cuts across every vertical, industry, use case, platform, customer size, you name it. It is a big landscape and it is changing – very fast. WhatsApp is bettering their platform, launching new capabilities on their WhatsApp Business Platform (API) every month, and new use cases are opened consequently.

Take every SaaS that exists today, and replace the SMS, Email, Livechat, and Phone dependencies with WhatsApp – this is your landscape. There will be a clear Mailchimp for WhatsApp winner, a Shopify over WhatsApp, a Zendesk over WhatsApp and I dare to say even a Slack over WhatsApp. In fact, there are many of those seeds existing today.

Here are the biggest fundraises for companies built entirely on top of WhatsApp –

WATI raised $23m

Charles raised $20m

Treble.ai raised $15m

Felix Pago raised $15.5m

Tuvis raised $11m

Landbot raised $8m

Luzia raised $10m

and many more smaller rounds!

Use cases

There are three dominant use cases – sales, support, and marketing. These are also umbrella covers and overlap with verticals, platforms and other types of businesses. After all, all businesses support, sell and market their products.

Marketing

This is perhaps the most important bet companies are making on the WhatsApp platform now. It is a risky bet, but oh well, with high risk comes high reward.

Why marketing? Simple, email marketing SUCKS, most email goes into spam, and the ones that come through have an open rate of a mere 20%. In some regions like LATAM or MENA, trust me – no one opens their damn email anymore over there. WhatsApp's open rate is 98%. Email is not going to die today, or maybe ever, but it is clear that certain parts of the customer journey are not valid for Email anymore.

So where does WhatsApp marketing fit? Big brands, specifically consumer ones, care about ROI. More and more budgets allocated to trying things out and experimenting. They ask what can we do to generate more sales? Brands want higher engagement rate to drive the consumer down through purchase funnel. There is no better channel than WhatsApp. High open rates, high every-other-metric down the funnel. The formula is simple: brands invest in starting conversations over WhatsApp, where open rates are exceptionally high, and ROI per conversation is high. Meta's interest lies in regulating content & delivery quality of the platform to keep the open rates as high as they are today.

So why do I assume high risk? Two things – margins, and regulations. Meta fees are paid to Meta directly by the business, or sometimes billed by the product company then some is paid to Meta. If the product is dedicated entirely to WhatsApp marketing, I'd definitely dig into their margins after Meta gets its cut. Another risk is regulations and Meta's direction – If I am in Meta's shoes, I'd fight hard to keep WhatsApp's pristine 98% open rate as is – and they are. This means Meta can change the rules and it can affect the trajectory and growth dynamics of a product company betting solely on the marketing use case for WhatsApp. There is an example of this when WhatsApp recently introduced per-user marketing messages limit.

Support

This tends to fall into two categories: (1) existing incumbents and (2) shiny new things.

Incumbents

Incumbents like Zendesk, Intercom, Front, and others understood fairly quickly that they need to go omnichannel – a business in Brazil will simply be out of business if they don’t support their customers over WhatsApp. What does Zendesk, Intercom and others do? Go omnichannel. Support WhatsApp, Messenger, Instagram, SMS, Phone, and so on.

Shiny new startups take the AI route – because it is incredibly hard for new startups to compete and win in the support use case against incumbents if you compete feature-vs-feature (I may be proven wrong with the likes of Superchat, Sleekflow, etc .. let's see!)

Startups

The second category only happened because of LLMs and AI progress in the last year. They are AI-first, built for WhatsApp, and trying to avoid playing the catch-up game with the incumbents. The thing is to build a customer support platform today to disrupt and/or meaningfully compete with incumbents: (1) you need to find a way to have a clear edge over incumbents (e.g. do what Linear did but for support, folks like Plain), (2) you need to be omnichannel from the get-go, and (3) you need to be an AI-first company. Winning in support now is tough but also ripe for disruption. We will see incumbents die, and some reborn in support.

Sales

I think this can be the toughest to crack but probably the biggest opportunity for startups to build on WhatsApp. Also, I am biased, because I am betting on this. 😉

This is more generic, wider in scope and ambiguous than the above two use cases. Every business sells. What kind of selling are we talking about here?

Two types of selling →

High volume, low price transactions

eCommerce is a visible vertical here, and Meta is betting big on this. Meta's released features over the last few years shows clear evidence that they want to make a dent here.

Usually, software companies building under this category have two modes:

(1) I want to offer an end-to-end eCom experience on WhatsApp including product discovery, cart management, payments, and notifications, – they do this either using Meta's commerce tools or they go fully betting on LLMs/AI.

(2) I want to offer part of the eCom experience on WhatsApp – part of the journey, maybe just the discovery, or just the payment, or the notification (cart recovery, delivery updates, etc), or the support for commonly asked questions.

You will find the likes of Hello Charles, Zoko, Interakt, and other much bigger companies working this category religiously.

Low volume, high price transactions

This is where you’re selling a home, or an expensive car, or even a B2B Software – if you're selling in this category, you need to build a relationship with the customer. Part of this can and will be automated, but doing this over WhatsApp is not figured out yet.

Think of a sales team with tens of SDRs and AEs in a SaaS company – their buyers don't use Email, they use WhatsApp. You're a sales rep, juggling multiple conversations with potential customers. You're switching between your CRM and personal WhatsApp app, trying to keep track of all the interactions. It's chaotic, it's stressful, and it's inefficient. Now, imagine a different scenario: all your WhatsApp chats with customers are managed from one place – synced with your CRM (HubSpot, Salesforce, Pipedrive, Zoho, etc). No more inefficiency, no more lost messages, no more chaos.

CRMs, sales engagement or conversational sales products, and the rest in this category will need to adapt. Because conversational buying, whether it is B2C or B2B is the future. A B2B buyer looking for a tool to help their sales team be more efficient, is the same exact human who starts their buying journey on their couch at night by scrolling through their instagram or Facebook – click, click, bought. B2B buying is changing and the change is in the conversational nature. Sales products need to adapt and use the best of the modern messaging apps.

Verticals

The main reason a startup would select a vertical and build around it on top of WhatsApp is that WhatsApp usually cuts across business functions (sales, support, activation, retention, etc). In messaging-first markets where WhatsApp is fundamental, usually a business sells over WhatsApp, then very soon after a transaction/deal is closed, the customer wants to stick around for support or to talk to the business for other reasons – support, activation, etc. This happens over WhatsApp too. Once started, a conversation over WhatsApp stays there, likely for the entire length of the customer's lifetime. So by default WhatsApp cuts through entire business functions within a company.

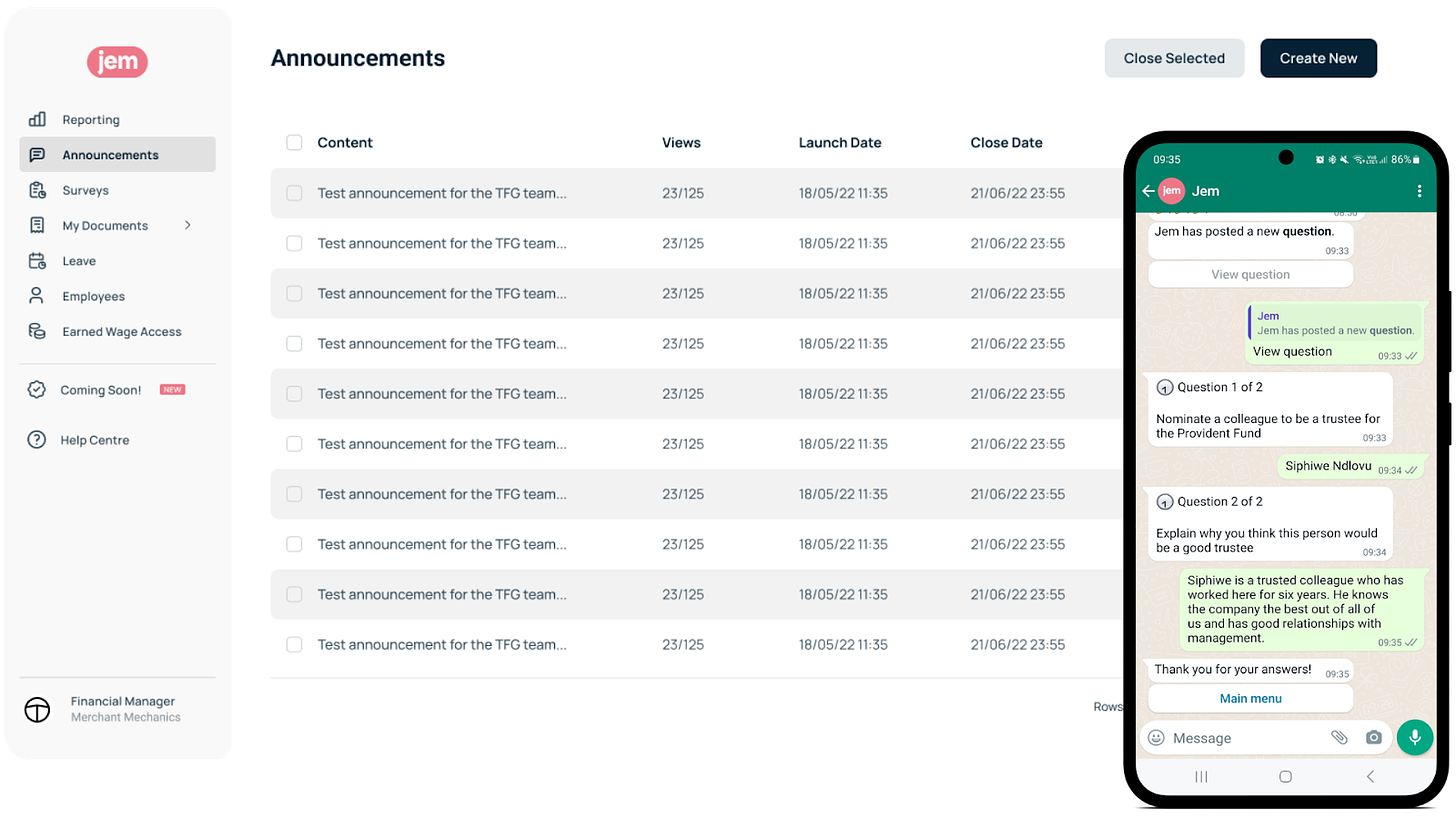

Take JemHR for example. They built their HR software to function natively over WhatsApp. Their product definitely has an interface, but the notifications, communications, documents, surveys and other features are the employee’s interface. It is that severe of a problem that the employees check their WhatsApp much more often than their Email.

The business that buys this software finds the utility extremely valuable because traditional HR software built over Email, or SMS, or whatever other channel don’t work for them anymore – specifically because those businesses are located in a high WhatsApp penetration geo like South Africa.

There are many examples of JemHR in other verticals, and there will be many more in the coming months and years.

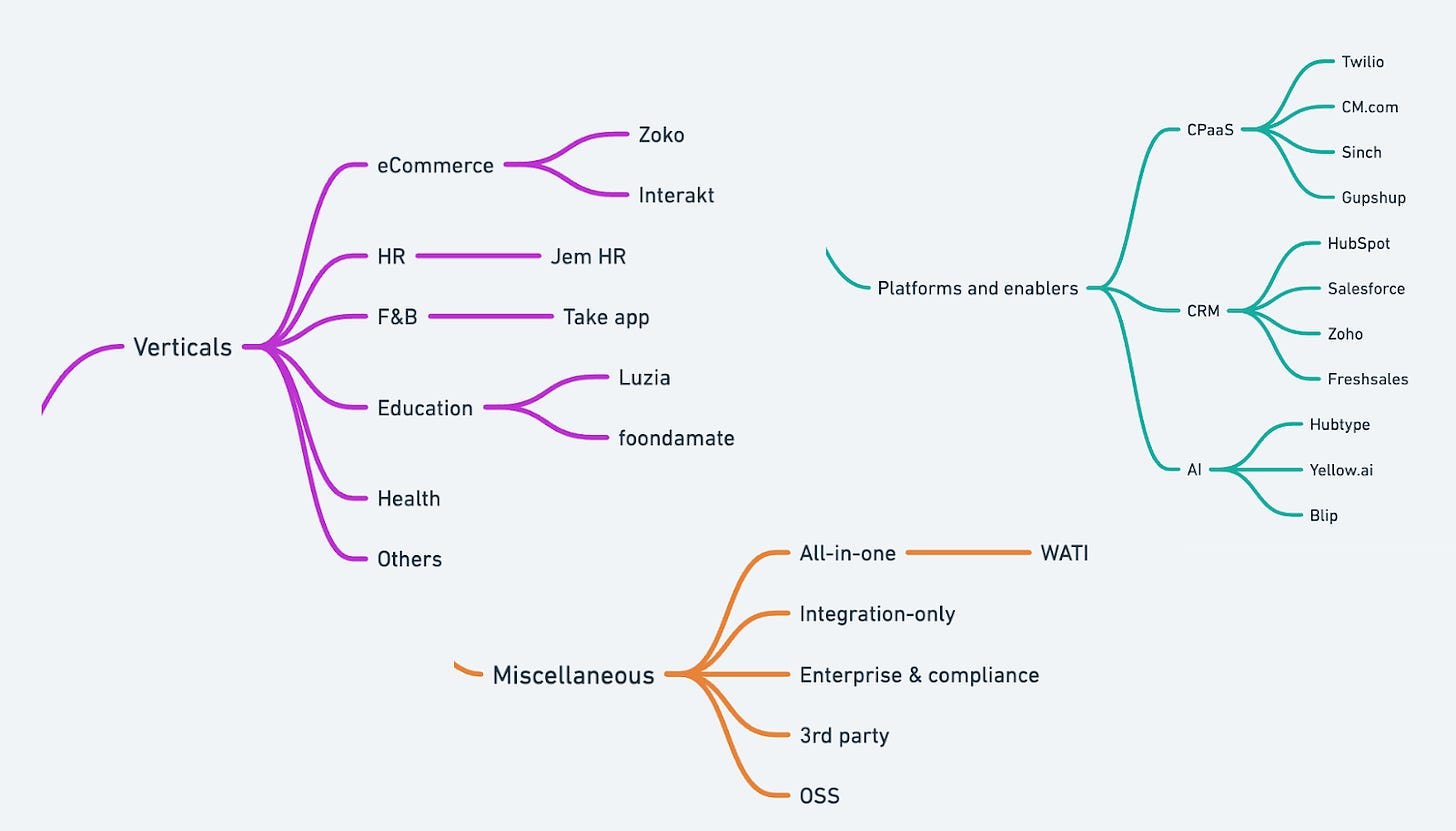

Platforms & enablers

CPaaS

Big elephant in the room: CPaaS companies. How do CPaaS companies stay relevant when they can’t really justify markup over meta conversation fees? Realistically, you can acquire a free WhatsApp Cloud API account and pay Meta their fees directly.

The answer is that it depends on the CPaaS company. Some can build good products, most don’t. Messagebird (Bird) had to re-invent a few times – they rebuilt their application-layer (inbox, etc) a few times to stay relevant. Others don’t seem to yet get the memo, or only consider WhatsApp as a complimentary channel to their much more core offerings (e.g. Twilio).

Integration-only

Other companies use WhatsApp in a different way. Their use case intersects with WhatsApp in a shallow way more or less, either that or they took the strategic decision to build or integrate just enough with WhatsApp to tick it off their list on sales calls. A good example of this would be CRMs – they tend to build a superficial integration layer with a communication channel like WhatsApp, and they strip off what makes WhatsApp actually special; its interactivity. While it alleviates some of the pain, it doesn't remove it. WhatsApp is a communication channel that's rich, interactive, realtime – the consumer bar is high for how they use WhatsApp, even when they start talking to businesses. A thin integration layer is sometimes worse than no integration at all.

While writing this part, I realised that I can write half a book on the landscape, and so I stopped myself before it is too late. I don't wish for that sip of coffee you took earlier to be a barrel. But I know you want to know more, so I promise that I will cover the rest (screenshot below) of the landscape in other articles. If you want to get an early draft, subscribe. 😉

Now to the more exciting part – how do you hunt?

Act V: How to hunt?

If you’ve reached this far, congratulations! This is where I have some half-decent advice to provide.

I thought about this for a while – a few years actually. The biggest concern for any VC betting on a startup built on top of a platform would be the platform risk, and rightly so. It is not a WhatsApp-specific risk or problem, it is a general platform risk. This is the same for a startup building on top of Salesforce, or Shopify, or Slack, or OpenAI, or even Apple. Unlike Email or other communication channels, WhatsApp is not an open platform or protocol. It is owned, managed and regulated by Meta. They have the final say. This can sound scary to an investor.

So I asked myself, is there a way I can quantify the risk of a platform? Specifically Meta/WhatsApp as a platform? Maybe there isn't a sure fire way, but there is something that can get us close enough.

I am not looking into elements like market size, product, traction, exit potential, PMF or your gut feeling about the founders – those are really dependent on the company and are foundational before we even quantify the risk of building over the platform. I leave these for you.

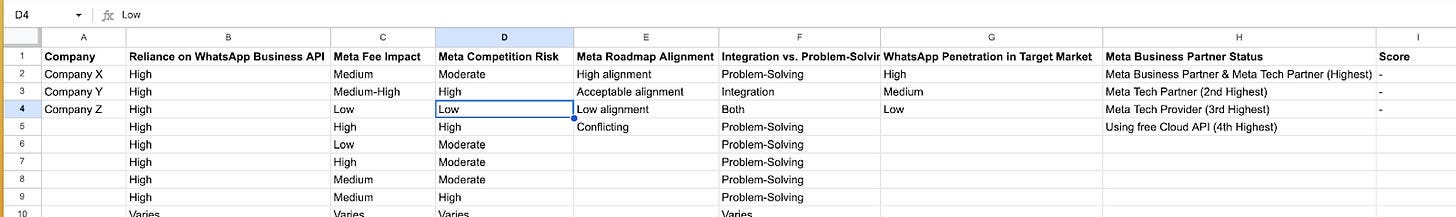

The formula

I came up with a few dimensions by watching Meta's manoeuvres and strategy closely over the last 6 years. I give each of the below dimensions a weight based on my answer's confidence.

Reliance on WhatsApp Business API

Is the startup using the official WhatsApp Business API (good) or a less reliable, potentially non-compliant workaround?

The more the company you invest in relies on the official WhatsApp Business Platform, the more solid this business' foundations will be.

You want to avoid startups building on top of any kind of reverse engineered WhatsApp Web API – solutions like this are a recipe for disaster. Not only is it hard to keep up with WhatsApp Web versions and it just stops working one day, but it also gets accounts banned, and sometimes forever. It goes against WhatsApp’s terms of service. More over, Meta is pushing more of its capabilities to their Cloud API.

Meta Fee Impact

How much of the startup's revenue will be eaten up by fees charged by Meta for using the WhatsApp Business API?

How much money does the startup make after Meta gets its cut? E.g. a plethora of startups building an abandoned cart notification over WhatsApp for Shopify; they can be profitable under certain conditions, but most are not sustainable or VC-fundable because of Meta fees and margins.

Meta Competition Risk

How likely is it that Meta will develop a similar product or feature, directly competing with the startup?

What is Meta unlikely ever going to build? E.g. Meta will likely never build a dentist software with 1-1 communications and consultations done over WhatsApp.

Any platform will give the builders a system of lego blocks. They do that because they want the builders to solve problems using the lego blocks, which will serve the greater good of their platform's users. The problems you’re solving should not go against or be in competition with the system of blocks, or the blocks themselves.

Meta Roadmap Alignment

Does the startup's product vision align with Meta's roadmap for WhatsApp?

Meta will keep releasing platform features and adding more capabilities. Do what they release match the problems you are trying to solve? Are you building with their lego blocks? Or are you building with virtual lego blocks that aren't yet a reality and possibly likely will not be?

Integration vs. Problem-Solving

Is the startup merely integrating with WhatsApp or solving a significant problem unique to the platform and the platform's audience? Or is it a thin layer on top of yet another platform?

I built my first bootstrapped startup and got it towards a million dollar in ARR entirely by building a thin integration layer to connect WhatsApp to Intercom. A couple of years later, Intercom built their own version, and the rest is history. You want to avoid this kind of situation. It may make for a good lifestyle business, but pose a big risk to a VC-fundable one.

WhatsApp Penetration in Target Market

What percentage of the target market actively uses WhatsApp?

WhatsApp ate most of the world's person-to-person communication. You want to invest in startups in regions where WhatsApp is interwoven into the fabric of the society – inseparable. WhatsApp has not yet peaked in the US but it will in time. As of today, it'd be a bad bet funding a startup built entirely over WhatsApp and trying to find customers in the US. The WhatsApp penetration and business-to-consumer WhatsApp communication opportunities in the US are not comparable to LATAM, or India, or big economies like Indonesia or the MENA region.

Meta Business Partner Status

What level of partnership does the startup have with Meta (Meta Business Partner & Meta Tech Partner, Meta Tech Partner, Meta Tech Provider, or using the free Cloud API)? Higher levels indicate greater access to resources and support, but also potential dependence on Meta.

A final but not scored dimension is the Meta Acquisition Friendliness – basically, to what extent does the startup's product or technology align with Meta's strategic interests, making it a potential acquisition target? Higher score in acquisition friendliness here is not a good thing. It is not a bad thing per se to be acquired by Meta, but it is just not an outcome liked or preferred for a VC investable business.

–

The final formula includes the dimensions we mentioned with almost equal weights except for 3 dimensions. The minimum possible score is -0.1 and the maximum is 3.0.

Let's take an example, an imaginary startup called CommerceUp. A company targeting e-commerce brands to help them sell more effectively using WhatsApp as a high engagement channel. Assume they are a Meta Business & Tech Partner. Their product works with Shopify, WooCommerce, and BigCommerce. We assume high reliance on WhatsApp because it is built on top the WhatsApp Business API (this is a good thing – they are not using a reverse engineered API), strong alignment with Meta’s roadmap being in the eCommerce vertical, and high penetration in the target market (they are targeting LATAM) outweighing the moderate negative impacts of fees. It is not a thin layer integration, it is a complete platform connecting the eCommerce platform stores with a 360 degrees buyer journey coverage over WhatsApp.

From a Meta's thesis point of view, a score of 2.8 (out of a possible maximum of 3) is what we got – I consider it a strong investment opportunity – assuming other foundational metrics an investor looking at are solid.

I scored 30 companies built on WhatsApp or using WhatsApp today as part of their product – if you want the excel sheet with the scores, be one of the first 10 subscribers (when I publish this) and I will send it your way 😉

Red flags

3rd party WhatsApp APIs

This is my number 1 red flag. Businesses should be built on solid foundations, specifically technology businesses. Brittle technology foundations kill businesses. There are a plethora of reverse engineered WhatsApp API options with paid services built on it out there. They do make and will make a lot of money, but it’s only temporary. This is a dangerous bet and an unsustainable risk. Not only that everytime WhatsApp changes something in their protocol or web clients, you face a big operational and reputation risk, but you’re also going against WhatsApp’s terms of service.

Taken from WhatsApp's terms of service:

(a) reverse engineer, alter, modify, create derivative works from, decompile, or extract code from our Services;

There are examples of other startups like Cooby or Tuvis that do this in a bit of a different way – as a chrome extension built on top of the existing WhatsApp Web (or desktop) interface. Hard to predict, but what if we see a future where WhatsApp focuses on native apps and deprecates the web version?

Meta's territory overlap

Meta made it clear it wants to help micro and small businesses with their WhatsApp Business App offering and all the tooling they provide around it. It is risky to offer the same or close offerings as Meta is to small businesses. The strategy is to help micro and small businesses succeed, so they grow out of those offerings and use the WhatsApp Business Platform (API) which is paid.

Ask yourself, what is Meta unlikely ever going to build? How likely is Meta going to build a dentist software with 1-1 communications and consultations done over WhatsApp? If the answer is extremely unlikely, then pursue.

Thin integration layer

This one is my favorite, because I built one doing exactly just that. I made some good money, took it all the way to almost a $1m in ARR. But this business was either an eventual small acquisition or a closure. It is simply not a VC investable business.

What is an example of such business? Octopods is one example. Intercom, at the time, was great for Live Chat and Email communication, but many of their customers wanted to use Intercom for WhatsApp (and other channels). So I went on and build Octopods entirely over Intercom – WhatsApp as a thin layer integration and it worked beautifully. But my entire business was one step away from Intercom’s product folks waking up one day and deciding to work on the same kind of integration and it happened when it made sense to them strategically. Luckily, this was a bootstrapped business and it was still worth it to start.

Lesson learnt – if I want a side business, then sure. A VC investable business dynamics is entirely unfit for this category.

Meta fees

Not to repeat myself, this is simple – make sure that the startup you invest in have good margins over Meta fees. Adding a markup over Meta Conversation fees isn’t a terrible idea, it can be very profitable when done right. But it is important to understand whether that markup is (1) high above Meta fees, (2) aligns with the startup’s customer incentives and shows clear ROI for them.

Act VI: Predictions

I think WhatsApp can be used in so many different contexts and ways – both in the B2B and B2C worlds. If Meta played this right, exposed the right building blocks for developers, regulated and policed it reasonably, stayed out of the way – builders will innovate and 100x its value + impact in the long run.

AI

LLMs, LVMs, LLAMs working together will change customers communicate with businesses. Sales, support, success, retention, and more will be changed forever by AI. We are seeing what this looks like for support. Expect this to massively increase WhatsApp's potency in the coming months and years. The more capabilities Meta released to their Cloud API, the more possibilities.

New capabilities are likely to affect the way Meta charges WhatsApp fees now – maybe it won't be per conversation anymore, maybe it will be through unit of work done, or through a markup over payment transactions happening over WhatsApp. Who knows, maybe Meta's Llama will also be part of this future.

Capabilities

If you want to know what's possible with the WhatsApp Messenger (the friends & family app), look into what Telegram does today. A fantastic app and platform. The WhatsApp Messenger is full of capabilities but has a bit of catching up to do to where messengers like Telegram.

Meta managed to bring much of the core features of the WhatsApp Messenger to the WhatsApp Business Platform (API). But the really powerful capabilities are still not opened up yet.

Channels, Communities, Groups, Voice & Video calls and many more – if those features are API'ified, it'd unlock an immense amount of value, possibilities and use cases for builders betting on the WhatsApp platform.

If WhatsApp provided some sort of WebSocket-based API for Video Calling tomorrow, I dare to say Zoom's stock ticker will take a dip. Builders will build a Zoom-equivalent over WhatsApp the day after the API's release.

Payments

This is not a prediction per se, because it is already happening. Keeping in mind WhatsApp's penetration in different geos around the world – WhatsApp can be potentially a bank-as-a-chat provider. There are endless possibilities here that I don't even know where to start, so I will leave it for your wild imagination.

Super App

Imagine a world where WhatsApp has tiny apps within the chat and I am not talking about WhatsApp Flows – tiny fully-fledged apps that installable, interactive, and can be part of a person-to-person chat, not just a business-to-person. You can search those apps, they can be triggered by just typing a message, a gateway to the world of apps outside. In this world, apps become irrelevant, WhatsApp is the OS. Unsure how that would sit with Apple though.

Community

WhatsApp already has a Community feature. If this is opened up as an API – builders will open up a world for better management, analytics, sentiment analysis, polls, paid subscriptions, and more to let community managers get the best out of WhatsApp communities. Meta themselves may offer these tools directly.

Business-to-employee (B2E)

In messaging-first geographies around the world today, employees would use WhatsApp over any other business communication tool. They'd make groups, and manage work there. I have heard this over many calls with companies – They don't find a better way than WhatsApp to reach or respond to their employees. Think an IT department receiving some ticket, they do that over WhatsApp. Collaboration inside of the workplace is an interesting category and I wonder how companies will cope with that over WhatsApp.

Marketplace

Briefly touched in the Super App prediction – imagine a marketplace of apps used to offer certain services with a chat-like interface to take certain actions. Order an Uber or a pizza, do your grocery – look for businesses close to your current location, and talk to them. Part of Uber's fourth quarter reporting for 2021 experimenting with WhatsApp:

Conclusion

We have gone through the story, a 360 view of the WhatsApp landscape, the formula to find your winning startup, and the red flags to avoid.

A few key takeaways –

WhatsApp is the new frontier: It's where the world communicates now!

Platform risk is real, but manageable: Use my formula to assess a startup's risk factor building on Meta, their ability to navigate the rules, and their potential reward.

Focus on solutions, not integrations: Look for companies solving real problems specific and aligned with WhatsApp's strengths.

Pay attention to Meta: Their moves and roadmap matter. Aligning with their vision can be a major advantage.

Watch out for red flags: Avoid risky bets on third-party APIs, businesses encroaching on Meta's territory, or thin integration layers.

Sales over WhatsApp: conversational buying, whether it is B2C or B2B is the future.

Phew, this was long. Even for me, the writer, to go through. You must be exhausted. Hope it was a tiny bit useful. If it is, then good news – I will write more, because there is much more to tell. If it wasn't, I am sorry. 🌹

A huge thanks to my close friend Mohamed Elbadwihi for his feedback, copy editing, and relentless encouragement to get this done.

Hello Tarek,

Thank you for sharing your thoughts on the article; I found it quite insightful.

I have a couple of points I'd like to discuss further:

1. If the Meta Suite application were to introduce broadcasting features, do you think this could present potential risks?

2. According to Facebook, the goal is to attract more business by enabling direct payments from end users, thereby reducing costs by eliminating middle service providers.

In light of these developments, do you believe that the key advantage we might retain lies in enhanced automations and integrations?

Looking forward to your thoughts.

Great stuff!